Metal Price News - September

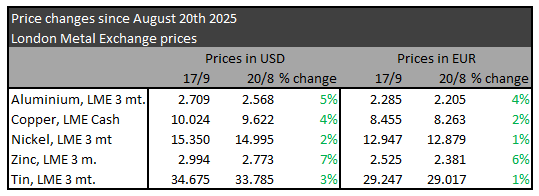

Copper and aluminium are on the rise, while stainless steel is still at a low level. The financial markets are keeping a close eye on the US Federal Reserve, which is expected to cut interest rates.

Macroeconomic developments

The war in Ukraine continues, and the peace talks in August did not lead anywhere.

Trump has been trying to put pressure on Russia, but his efforts have not caused any major movements. Most recently, Trump urged NATO countries to increase tariffs on China and India by 50% and 100%, respectively, as long as China and India continue to buy fuel from Russia.

United States

In the last few weeks, the US economic indicators have drawn some attention. Employment is falling, and consumer and producer prices are rising slower than previously. Inflation is also lower than in recent months, but still above the 2% target.

Overall, the declining trends have caused the markets to expect an interest rate cut of 0.25% at the FED meeting today (September 17th). On Monday, Trump’s economic advisor Stephen Miran was confirmed as member of the FED, and he is expected to vote for a 0.50% cut.

Trump has previously called for a 1% cut, and it will be interesting to see his reaction when the FED announce their decision.

China

The Chinese economy is still struggling as both private consumption and the housing market have stalled. On a positive note, exports have increased by almost 5% in the past year. However, companies are fighting harder to sell their products, which means lower prices and tight profit margins. As a result, the share of industrial companies that are not turning a profit is at the highest level in many years.

Regarding a possible tariff agreement with the US, there is nothing new to report.

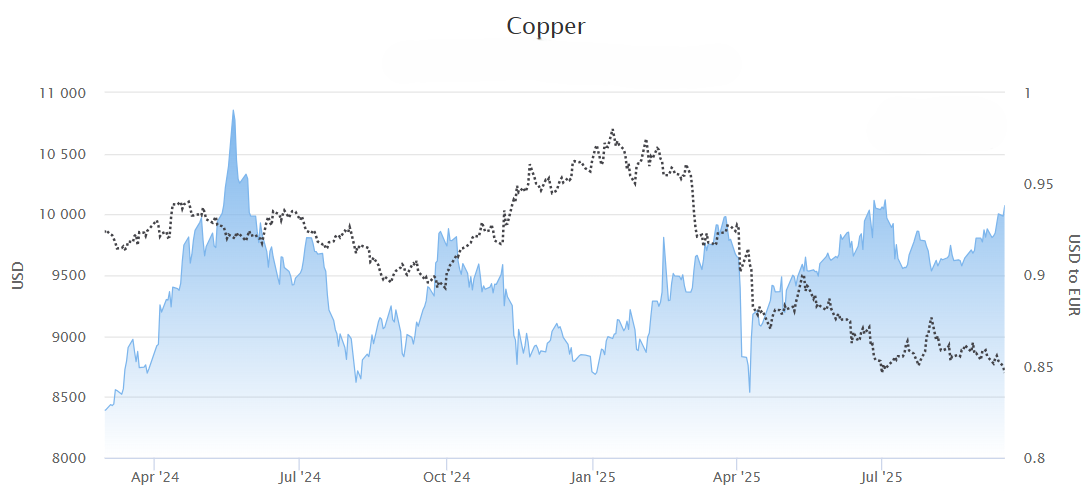

Copper

The copper price has been steadily rising over the past month, and last week it managed to climb above the USD 10,000/t mark. This is the highest price since mid-March, and we have not seen a price this high for 3 consecutive days since May 2024 (3 month price).

There are several reasons for the price increase:

- Production is declining in China, and a mining accident in Indonesia has also limited production there.

- Partly due to Trump’s many political announcements, the stock markets have been volatile, and inflation is uncertain. This is causing more investors to turn towards the traditionally “safe” investments such as gold, silver and copper.

- Copper is traded in USD, and the dollar is weak at the moment. If we look at the price in euros or the Chinese renminbi, the price increase is less significant.

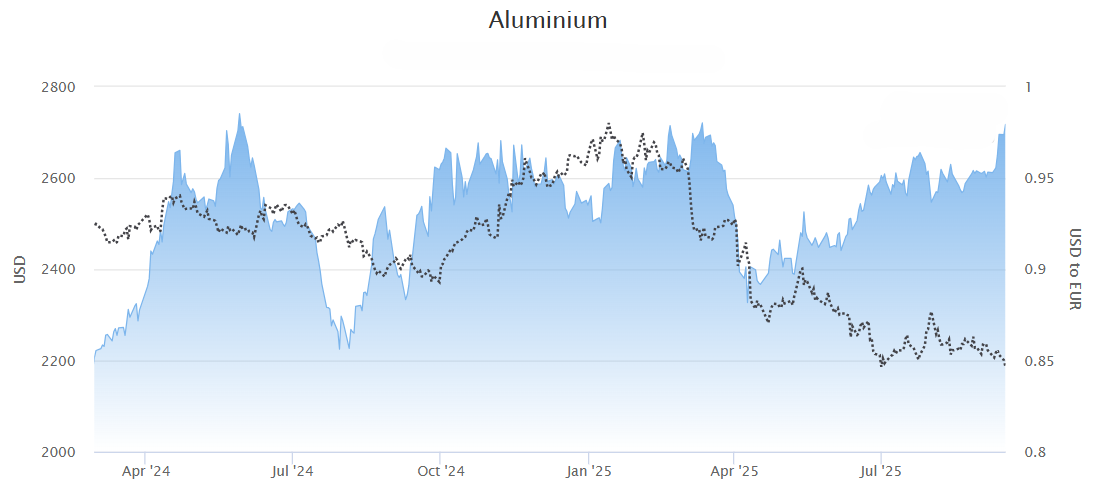

Note the USD/EUR trend (dotted line) on the graph below compared to the recent price increase. - The combination of rising prices and falling supply has led companies to bulk up their copper stocks, which is pushing the price up further.

Aluminium

Aluminium is also on the rise – and more so than copper. Since our last update in August, the aluminium price has gone up 5% (USD) while copper has gone up 4% (USD).

But unlike for copper, there have been no major news to explain this trend. We expect that some of the factors mentioned above – especially nr. 2 and 4 – are also affecting the aluminium price.

Last month, we predicted lower aluminium prices towards the end of the year. This is still our expectation, although the price is moving in the opposite direction right now.

Stainless steel

On stainless steel, the market is still highly hesitant while juggling a number of uncertainties; it is still unclear how CBAM, the EU's Carbon Border Adjustment Mechanism, will work, and Trump's tariff policies are also causing uncertainty in the market.

Sheets/plates

As we wrote last month, there are talks of price increases in Q4. The mills have been under pressure all year, and the price level is too low to be sustainable – but activity in the market is still so low that it will be difficult for the mills to push for any more than moderate increases.

Bars

There is not much new to report on bars. Lead times are short, and we expect a slight increase in the alloy surcharge for 4404/316L.

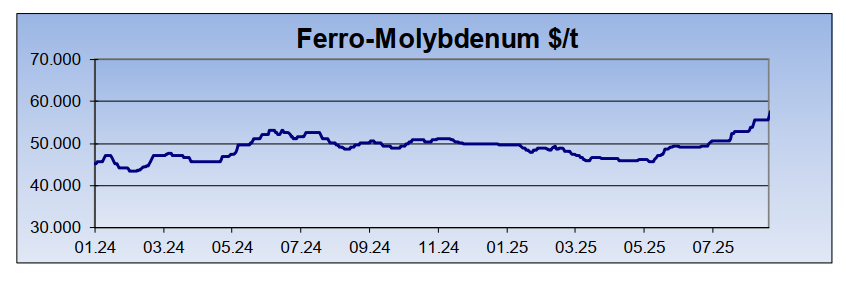

Molybdenum

Molybdenum continues to move upwards, which is why we are seeing higher prices on 4404 (a molybdenum alloy). Recently, the molybdenum price hit a 2-year high at $57,000/t.