Metal Price News - October

The trade war between the US and China has picked up again, but at the same time we are seeing moves towards peace in the Middle East. These conflicting sentiments are causing confusion in the financial markets, but overall prices have increased since last month.

Macroeconomic developments

Generally speaking, the markets have been calm and optimistic over the past month. This is partly due to the fact that the US interest rate was lowered last month and that there are signs of a serious ceasefire in Gaza. But since Trump made new tariff threats to China last Friday (10 October), the market sentiment has changed.

USA

After the United States restricted the sale of chips for supercomputers to China, China responded by restricting exports of rare earth minerals, which are used for batteries, computer chips and in the weapons industry, among other things. On Friday, Trump responded by threatening a 100% tariff increase on Chinese goods, and yesterday (Tuesday) China imposed tariffs on US ships docking at Chinese ports. The situation is constantly evolving, and there is no telling where it will end. This uncertainty has so far caused sudden drops in the market with each new development.

Looking at the US alone, there are no economic indicators for the economy at the moment. The US public sector, including the financial offices, has been shut down since budget negotiations for 2026 reached a deadlock last week.

China

For several months now, we have told the story of a sluggish Chinese economy. But right now, things are looking better: The World Bank now expects Chinese growth to hit 4.8% in 2025, close to China's own target of 5% growth. Both imports and exports in September are also looking better than expected with increases of 7.4% and 8.3% respectively on an annual basis. Golden Week and several government-led infrastructure projects seem to have caused this boost.

Europe

Like the US, France is also struggling to reach a budget agreement for 2026, and the overall trust in President Macron and his appointed prime minister is lacking. At the same time, German manufacturing in August was a disappointment with a 4.3% drop in production – the biggest drop in 2.5 years.

Both are causing European stock markets to fall and weakening the euro against the dollar.

Copper

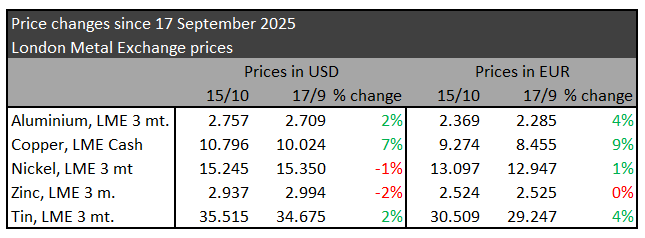

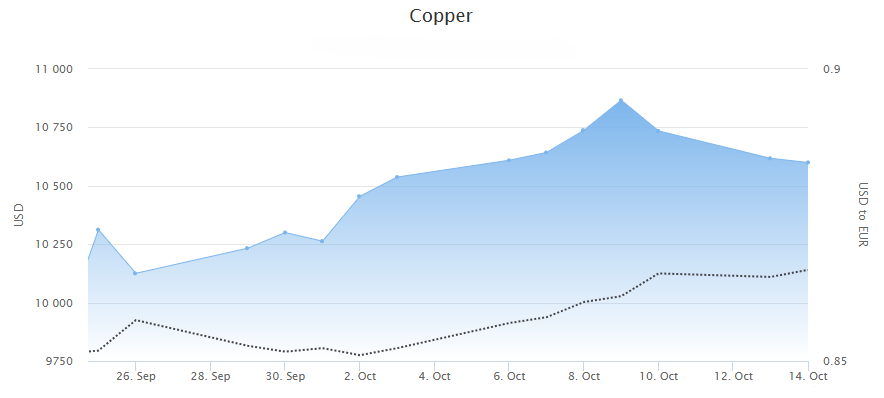

Last month, we described four reasons why the copper price is close to an all-time high. The mining accident in Indonesia is the biggest factor, as the mine accounts for 4% of the global copper production – and this is the third accident in a major copper mine this year. The mine is unlikely to run at full capacity in 2026 due to the damages, and this has pushed prices up, partly driven by speculators in the market.

Another factor is the continued movement towards the traditionally "safe harbour" investments such as gold and silver, which is also attracting slightly more investors to copper.

Overall, these factors pushed the price to the second-highest level of all time on Thursday (9 October) – before the trade war between China and the US lowered the price slightly again.

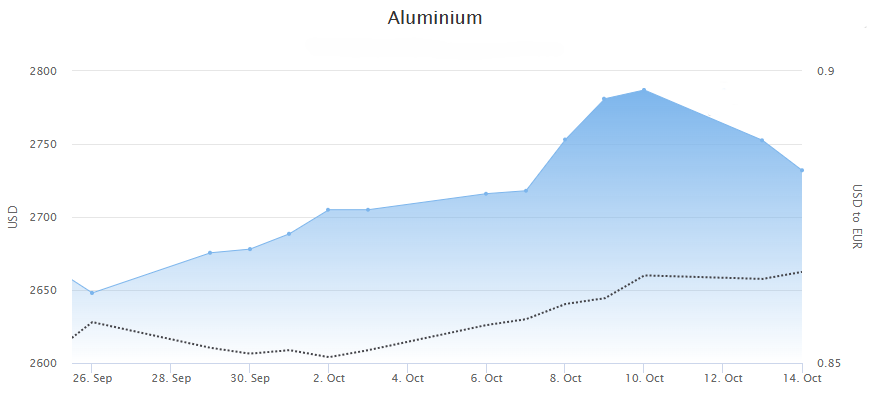

Aluminium

Just like last month, aluminium is trending like copper despite the lack of major news in the aluminium market. CBAM, the EU carbon tax, which will begin on 1 January, is likely causing some uncertainty in the market.

Stainless steel

On stainless we are definitely seeing the uncertainties around CBAM and another EU measure, the safeguard quota.

CBAM payments will come into force on 1 January, but a lot of details are still unknown – such as standard values for carbon emissions if a mill does not have verified figures for its own emissions.

An interesting question is whether the European importers will be the ones to actually pay the tax – as it is intended – or if the Asian mills choose to offer a price discount to mitigate the tax. The question is: Who has the upper hand in the market?

The same question goes for the safeguard quota. The quota will be reformed in 2026, and right now everything points to reduced quotas, meaning more goods will be taxed when they are brought into the EU.

With this combination of CBAM and a reduced safeguard quota, the incentive to produce stainless steel in Europe will grow, as imports from Asia will be noticeably more expensive.

Sheets/plates

Prices are starting to rise, and we expect this to continue for the rest of the year. As we have previously written, the mills need to push prices upwards to remain financially sustainable, and this seems to be happening now.

Bars

Lead times are short, and the alloy surcharge remains stable.

Molybdenum

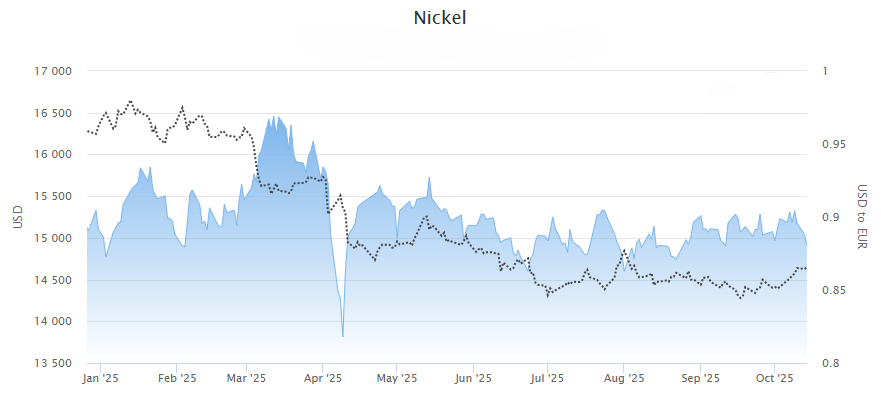

Both nickel and molybdenum are at a stable level, which is why the alloy surcharges remain the same. Molybdenum, an important alloying element in 4404, has soared in recent months, but this trend seems to have slowed down.