Metal Price News - June

Commodity prices seem paralysed at the moment. The constant flow of news – positive as well as negative – has not spurred major price fluctuations. This indicates that the market is awaiting something to hold on to.

Macroeconomic developments

This month has seen one news item replaced another at a high pace.

Last week, China and the United States agreed on a trade agreement. Under the agreement, Chinese goods to the US will be taxed at 55%, while US goods to China will be taxed at 10%.

On the same day, the World Bank announced that they would lower the expectation for global growth in 2025 to 2.3%. This is the lowest global growth since the 2008 financial crisis.

Later that week, Israel began bombing in Iran which has left the markets on hold for the time being. The big question is whether the US will actively join the conflict – the current estimate is that the likelihood of US intervention is above 50 %.

United States

In the US economy, inflation has been the major point of interest for a while now. The numbers are looking good, but the US Federal Reserve (Fed) is expected to keep interest rates at the current level at their meeting today (June 18).

Trump has tried to pressure the Federal Reserve into cutting the interest rate by as much as 1%, but the bank has not been willing to do so.

Currency

The dollar has been weakening since Trump’s inauguration, and that trend seems to continue with the current economic state. To make matters worse for the USD, a new fiscal framework in Germany has strengthened the EUR.

Copper

Copper prices have been at the low end of the usual range, but the situation in the Middle East has caused prices to rise in the past few days.

The otherwise low level was partly due to the struggling Chinese real estate market. With a low demand for property development, the demand for copper wires, piping etc. is low.

In April, Chinese house prices saw the biggest drop in 7 months.

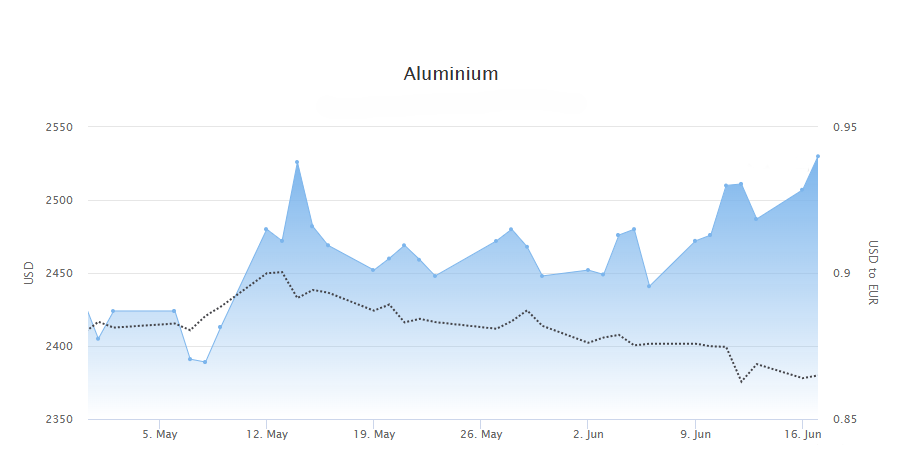

Aluminium

The price of aluminium has just broken the USD 2,500 threshold due to the Israel-Iran conflict. The price has approached USD 2,500 several times in the past month, but until yesterday (Tuesday) it had not managed to break through that point.

At the same time, the global supply of aluminium is creating a price risk: Chinese aluminium stocks are at their lowest level since 2016, which increases the risk that some trades on the London Metal Exchange (LME) will be caught in a short squeeze. Such a situation could cause cash and short-term aluminium prices to rise sharply.

Stainless steel

On stainless steel, the caution in the market is very clear. Trump's many different tariff announcements and his focus on domestic manufacturing is especially affecting pharma, because there is uncertainty around the major pharmaceutical companies.

At the same time, Germany and Italy are still struggling with sluggish growth, and because they are major steel consumers, this is affecting the entire European supply chain.

In the bigger picture, the OECD has just released their Steel Outlook 2025. Here, the OECD estimates that there will be a global overcapacity of steel of 721 million tonnes in 2027. This is more than twice as much as the OECD countries' total production in 2024.

The overcapacity comes mainly from subsidised expansions in China.

In response, the EU has tightened import rules so that European mills can regain market shares after a long period of pressure from China and the United States, among others.

Sheets/plates

We expect prices to be under pressure at least until the summer holidays. Activity is low and imports to the EU are high – and the weak dollar exchange rate only makes imports even more attractive.

The low activity also means that the mills in southern Europe will shut down in August. Some mills have even announced temporary layoffs.

Bars

Generally speaking, bars are a stable market. But long-term it will be interesting to see how the specialised long product mills will adapt to growing competition on standard commodities from the mills that have both flat and long production.

Tubes

The tube mills are also under pressure from imported material and have been for a long time. The mills had managed to raise prices earlier this year, but they have had to lower them again.

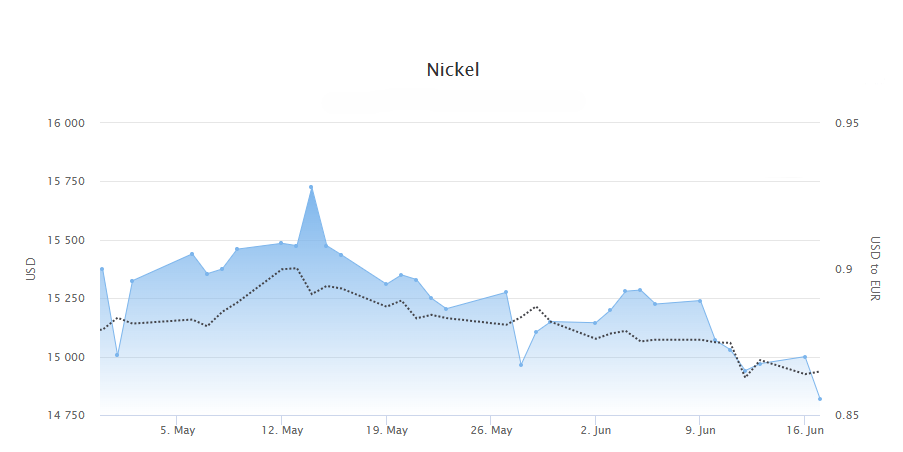

Nickel

After an unusually low price in April, nickel has recovered a bit. The price has once again climbed just above $15,000/t, where it has been for most of the year.

This is still a low level compared to previous years, but it seems to be a stable level at the moment.

On the other hand, alloy surcharges have decreased from May to June, and in July we expect a decrease of 1.6% on 4301 and an increase of 0.6% on 4404.

In July, the monthly analysis will take a break due to summer holidays in the industry.