Why the whole world is short of magnesium

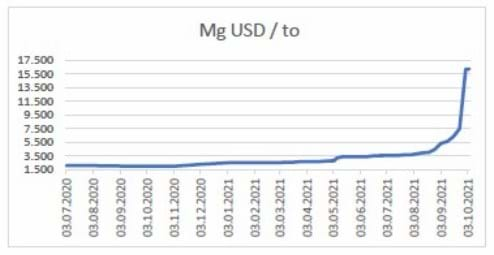

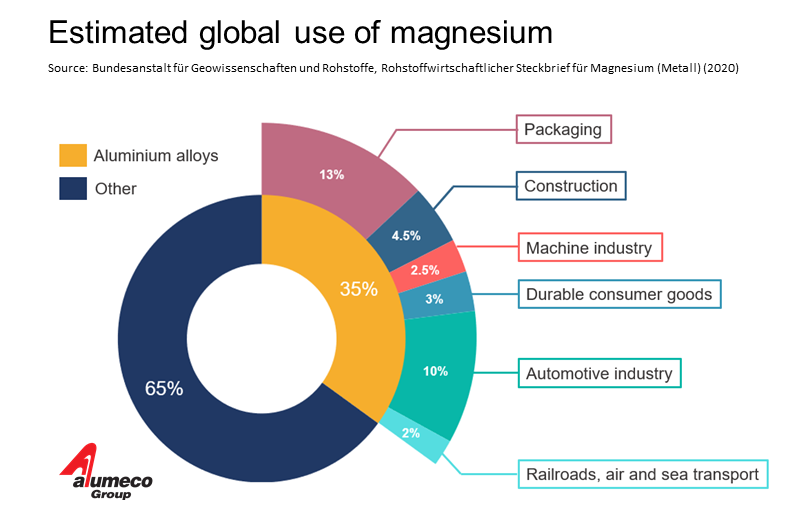

Magnesium is an important alloying element in aluminium, especially in 5xxx and 6xxx alloys, but the global magnesium stocks are running out. As a result, prices are soaring and the raw materials crisis is worsening. In this article, you get the full picture of the situation.

China reduces magnesium production

China produces 87% of all magnesium in the world. But in order to live up to its green ambitions, China has reduced the production of magnesium from September to December 2021.

The climate goal is to reduce power usage by 3%, but the country is also facing a coal shortage at the moment. The result is that power is limited in several provinces, and since magnesium production is very energy intensive, the production is severely reduced.

This is causing problems for Europe, because 95% of all magnesium used in Europe is imported from China. As Israel is the only other primary producing country to export magnesium, the global market is completely dependent on Chinese export.

Furthermore, magnesium is not well suited for long-term storage, as it begins to oxidise after 3 months. This means that the shortage of magnesium will soon reach a critical point if China maintains the reduced production.

Still massive shipping bottlenecks

The massive bottlenecks in global shipping are still causing great delays and shaky supply chains, which is also impacting the price and availability of magnesium. It is difficult to get a container for the goods, to get the container on a ship and to unload the container in the receiving port.

These kinds of freight crises usually blow over in a quarter or two, but WGM is not expecting the knot to loosen until 2022 and a complete normalization until 2023.

One reason is that the freight market has still not caught up with the burden from 2020, when many manufactures scaled back their production to prepare for a crisis while the consumers surprisingly increased their demand for consumer goods. In addition to this, single events such as the blocking of the Suez Canal and temporary lockdowns of local ports due to COVID-19 have further worsened the situation.

5xxx and 6xxx alloys take the hardest hit

The magnesium shortage is currently impacting 5xxx and 6xxx aluminium alloys the most, especially sheets/plates and profiles. In these alloys, magnesium is the main or the only alloying element and cannot be substituted with another metal.

Magnesium is a critical raw material

Since 2017 magnesium has been on the EU’s list of critical raw materials, which makes the dependence on China a problem for the supply chain security. The US produces its own magnesium and is less dependent on other countries, but it is not expected that the US will export magnesium.

The worst-case scenario for the magnesium shortage is that it will put the brakes on the European and global economies, because magnesium is essential to aluminium production.

Furthermore, the European demand for magnesium is expected to rise in coming years, because magnesium is used for products such as electrical vehicles.

Source: WGM

Read more

Do you want to know more about the shortage of aluminium? Read our analysis of the global aluminum market in 2021 here.